|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

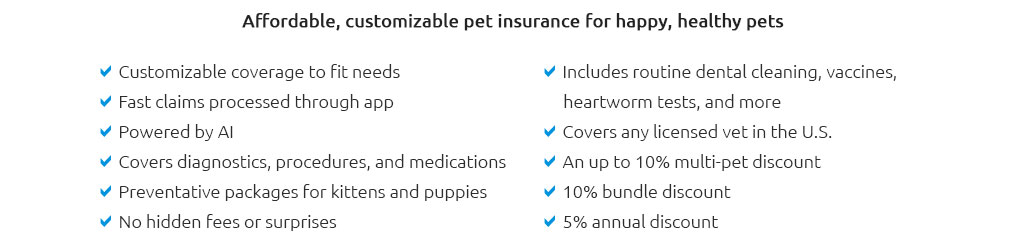

Best Pet Insurance for Big Dogs: Key Features and HighlightsWhen it comes to finding the best pet insurance for big dogs, there are several important factors to consider. Larger breeds often face unique health challenges, which makes choosing the right insurance plan crucial. This guide will help you understand the key features to look for and highlight some top options in the market. Why Big Dogs Need Special ConsiderationBig dogs are wonderful companions, but they come with their own set of health risks. Larger breeds are prone to conditions such as hip dysplasia, heart issues, and joint problems. As a result, it's essential to have a comprehensive insurance plan that can cover these potential health concerns.

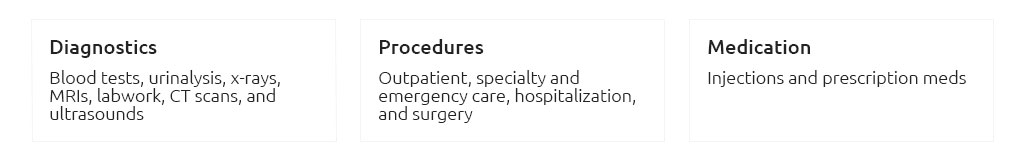

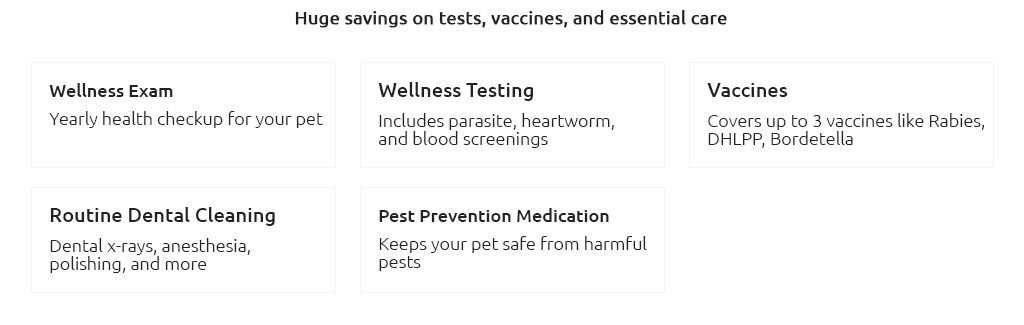

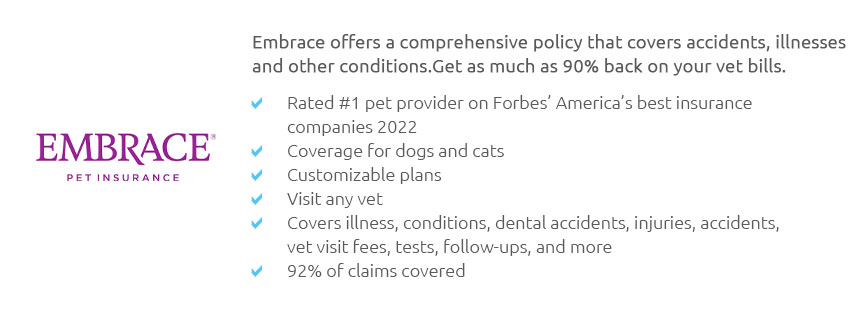

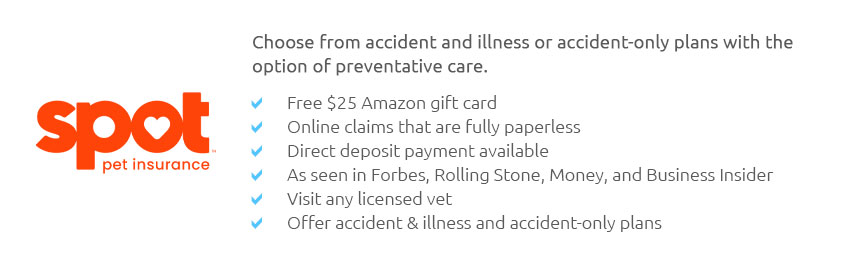

Key Features to Look for in Pet InsuranceCoverage OptionsEnsure the plan covers a broad range of conditions, including hereditary and congenital issues. Look for policies that offer flexibility in choosing your coverage levels. Reimbursement and DeductiblesConsider how the plan handles reimbursements. A higher reimbursement rate may mean lower out-of-pocket costs. Also, check the deductible options and choose one that fits your budget. Annual LimitsBe aware of the annual coverage limits. Some plans have caps on how much they will pay each year, which can impact your choice if your dog requires extensive care. For further insights on local options, you might want to explore pet insurance vancouver wa which provides regional information and reviews. Top Pet Insurance Providers for Big DogsSeveral companies stand out for their comprehensive coverage and excellent customer service. Here's a quick overview:

For a broader perspective, check out different pet insurance websites that offer comparisons and detailed reviews. Frequently Asked QuestionsWhat should I look for in a pet insurance plan for a big dog?Look for plans that cover hereditary conditions, have flexible reimbursement and deductible options, and offer high annual limits. Are there specific conditions big dog insurance should cover?Yes, ensure the policy covers common issues like hip dysplasia, heart conditions, and joint problems prevalent in larger breeds. How can I reduce the cost of pet insurance?Choose a plan with a higher deductible or lower reimbursement rate. Additionally, consider multi-pet discounts if you have more than one dog. https://www.pawlicy.com/blog/pet-insurance-for-large-dogs/

In general, the larger the dog, the more expensive they are to insure. Insurance providers charge higher premiums for larger breeds because these dogs tend to ... https://www.cnbc.com/select/best-pet-insurance-for-dogs/

Pets Best has low rates for older dogs and no upper age limit for coverage. In addition, its basic plan covers periodontal disease and ... https://www.quora.com/What-is-the-best-pet-insurance-for-older-dogs-with-pre-existing-illnesses

Finding pet insurance for older dogs with pre-existing conditions can be tricky, as most policies don't cover them. However, companies like ...

|